U.S. Taxes

DISCLAIMER: International Student & Scholar Services (ISSS) is neither licensed nor qualified to provide tax advice and will not do so. The information provided is intended for your benefit. Any questions or concerns should be directed to TerpTax, a certified tax preparer or a local IRS field office.

Updated 1/6/2026

Who must file taxes?

All international students and scholars have a federal tax annual filing requirement irrespective of their income. IF NO U.S. source income and under F, J, M or Q immigration status during 2025 and:

-- presently in the U.S. , Form 8843 must be filed by April 15, 2026, or

-- NOT presently in the U.S., Form 8843 must be filed by June 15, 2026

How do I prepare my taxes?

View the Feb 18th presentation with Professor Samuel Handwerger of UMD's Smith School of Business and TerpTax advisor on how to prepare taxes, specifically geared for international students.

View RecordingThe deadline for filing 2025 Federal Tax Returns is

Wednesday, April 15, 2026.

STATE RETURN DEADLINES

| State | Income Tax Filing Deadline |

|---|---|

| Maryland | April 15, 2026 |

| Virginia | May 1, 2026 |

| Washington, DC | April 15, 2026 |

FAQ'S for Non-Residents for Tax Purposes

- I didn't earn any income. Do I still need to file?

- How can I get a copy of my W-2?

- What is the deadline for filing my 2025 tax forms?

- What assistance does the University provide?

- What forms do I need to file my Federal tax return?

- How do I start filing my taxes?

- Am I a resident or non-resident alien for tax purposes?

- Can I file my Federal tax return electronically?

- How can I file for an extension?

► I didn't earn any income. Do I still need to file?

Even if you don’t earn money during your time in the US, you will still need to file Form 8843 with the IRS by the deadline. ALL of the following individuals who were in the U.S. for any period of time during the calendar year must file federal tax filing obligations the following year:

- international students

- international scholars

- dependents of international students and scholars

► How can I get a copy of my W-2?

Information on how to obtain a copy of your W-2 can be found on the Comptroller of Maryland website.

Return to Top

► What is the deadline for filing my 2025 Federal tax forms?

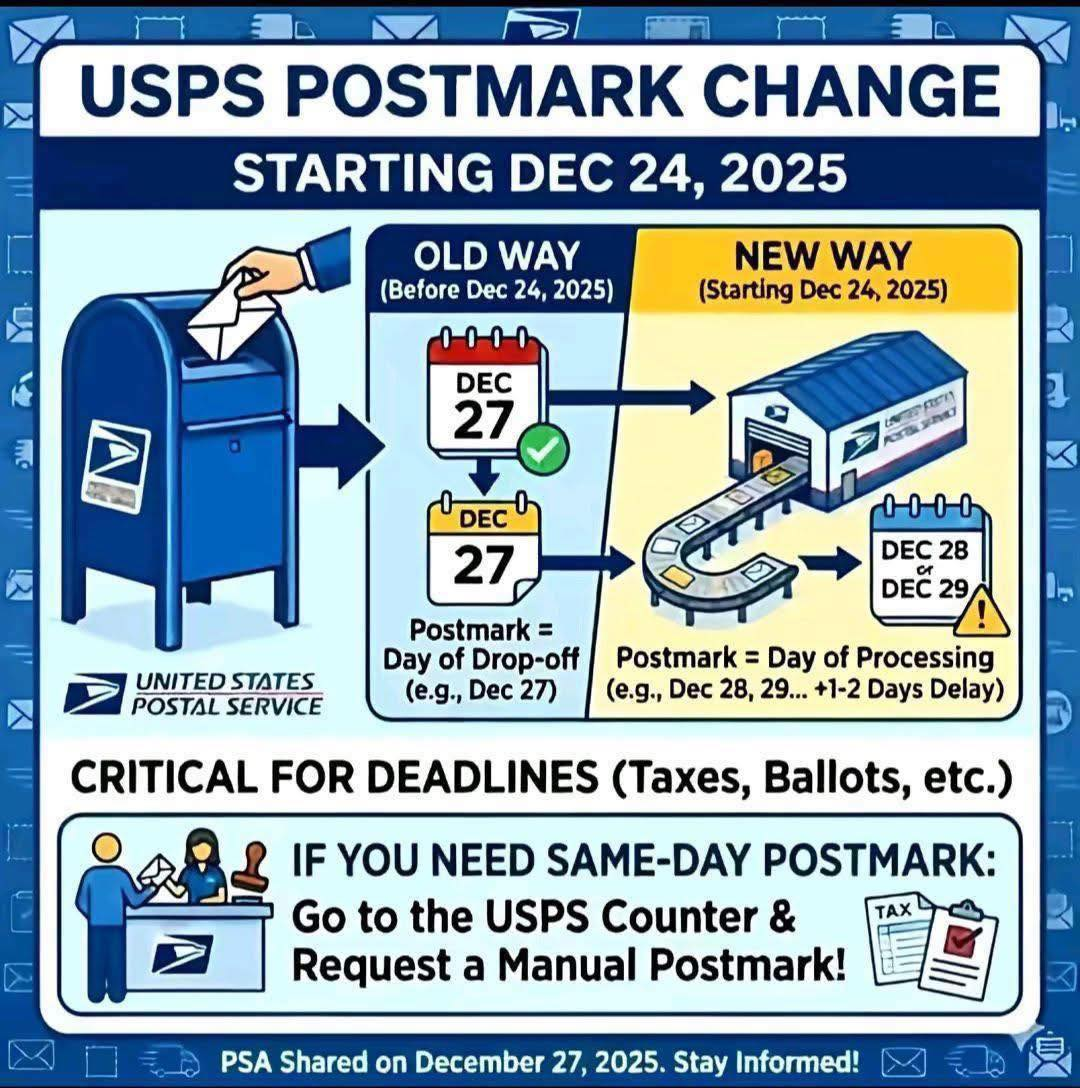

The deadline for filing your 2025 Federal Tax Return is April 15, 2026. Your envelope must be postmarked by 11:59pm on that day. (Important: Changes to the USPS Postmark "date" received)

Return to Top

► What assistance does the University provide?

- TerpTax housed in the Robert H. Smith School of Business, is a Volunteer Income Tax Assistance (VITA) chapter, a program created by the Internal Revenue Service (IRS) to provide FREE tax return preparation to low-to-mid-income individuals and families, the elderly, students, and persons with disabilities. Visit TerpTax to find information on what to do to prepare for your appointment and to schedule an appointment with a TerpTax representative. They will be taking appointments from February through April.

- GLACIER Tax Prep can be used free of charge by F-1/F-2 and J-1/J-2 status holders to prepare their U.S. Federal income tax return.

Glacier Tax Prep will be available early February for this filing season.

► What forms do I need to file my Federal tax return?

- If you were working (ex: graduate assistantship, hourly on-campus position) in 2025:

- You will be sent a W-2 statement (January 31)

- If you received a scholarship/fellowship OR you are claiming a tax exemption due to a TAX TREATY in 2025

- You will be sent a 1042S form (March 15)

If you need to request a Duplicate W-2 or 1042-S, go to Central Payroll Bureau's Payroll Services for State Agencies website and follow instructions.

► How do I start filing my taxes?

- Federal - First complete your federal tax return. Information from this form is required to complete your State tax return. Login to Glacier Tax Prep (following the instructions above) to complete your Federal tax return.

- Form 8843 Required - This form is generated by Glacier Tax Prep.

- State - For assistance with the State tax return, you can get assistance from:

- TAP - For graduate students only

- MSLC VITA at R. H. Smith Business School

► Am I Resident or Non-Resident Alien for Tax Purposes?

Login in to Glacier Tax Prep (following the instructions above) to determine your tax status. If you are a Nonresident Alien for Tax Purposes (NRA), you should use Glacier Tax Prep to complete your Federal tax return. Only NRAs can use Glacier Tax Prep. We recommend that NRAs do not use other commercially available tax preparation software products, like TurboTax, that do not perform the NRA calculation.

If you are a Resident Alien for Tax Purposes, you can use TAP or MSLC VITA resources to help you with completing your tax return.

► Can I file my Federal tax return electronically?

No, you must print, sign and postmark you tax return no later than 11:59 pm on April 15, 2026. The address to file your tax return if no payment is required:

Department of Treasury

Internal Revenue Service Center

Austin, TX 73301-0215, U.S.A.Remember to keep photocopies of all documents you send to the IRS.

If you need to submit a payment with your tax return, see page 3 "Where to File" - Instructions for Form 1040 NR-EZ.

Please be aware of the following change in the postmark procedure: The postmark (the date "received" by the post office that the IRS considers for tax deadlines) may be a few days after you put your tax documents in a post office box. If you are filing close to a deadline, please go to a USPS office and get a manual postmark so that your documents will not be marked as late.

International Student & Scholar Services provides this tax resource information to UM students and scholars for informational and educational purposes and not as a substitute for advice obtained from the Internal Revenue Service (IRS) or a qualified tax professional. Students and scholars who have questions about their income tax situation should consult a qualified tax professional. Each person is responsible for the accuracy of his/her income tax returns and any resulting penalties or interest.